Factoring

Factoring without secrets.

We increase the security and financial liquidity of our clients.

What is factoring?

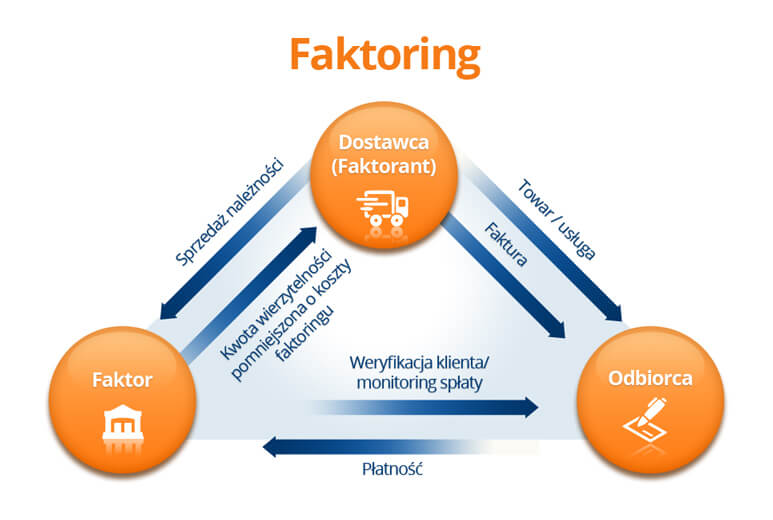

It is a financial service consisting in the purchase of undue receivables by a specialized factoring company.

How does it work?

Types of factoring

- Recourse factoring – the factor buys the debt but does not bear the risk of the debtor’s insolvency;

in case of the lack of timely repayment, it is entitled to recourse to the company selling the receivable - Non-recourse factoring – the factor takes over the receivable together with the risk of the debtor’s insolvency

- Mixed factoring – the liability is spread between the factor and the seller of the debt

- Secret factoring – a product for companies whose business partners have a contractually agreed ban on assignment of receivables; the debtor receives only and exclusively information about the change of account, which is given on the new invoices.

Benefits of factoring

- a source of financing for current operations

- shortening the period of receivables collection

- the possibility of using longer payment terms without reducing liquidity

- alternative to a working capital loan

- reduction of commercial risk (with non-recourse factoring)

How do we work?

Unity Brokerage Group analyses our customers’ financing needs and recipient structure, then we recommend choosing the type of factoring and, after comparing factor requirements and cost conditions, also choosing a factoring company. Moreover, we ensure appropriate cooperation of factoring with other financial services, e.g. trade credit insurance